WEST PALM BEACH, Fla. — Getting their hands on a loan through the federal government's Paycheck Protection Program has been highly coveted by small businesses since the economy hit a wall this year.

The $350 billion program is intended to provide small businesses with cash flow via federally-guaranteed loans. However, the ambiguous rules associated with the program have many asking questions.

What are the stipulations? Would some businesses be better off riding out the next few months without the loan?

SPECIAL COVERAGE: Coronavirus | The Rebound South Florida | We're Open South Florida

On Tuesday, the U.S. Small Business Administration posted a 15-page list of frequently asked questions related to the PPP program.

Some businesses say the terms of when the loan has to be used, in order to be eligible for maximum forgiveness, are difficult to meet.

This is especially when many businesses can only operate at 25 percent or are not operating at all.

On Wednesday, some local business owners shared with WPTV their experiences obtaining PPP loans.

Pivoting to take out to stay in business, fine dining restaurant Casa D'Angelo in Boca Raton is seeing some light at the end of the tunnel after receiving a PPP loan.

"I got my funding in the first round, and it was a relatively easy process. I know I'm the exception, not the rule," said Jason Sobel, director of business development and finance for Casa D'Angelo.

They were one of the first businesses to get funding, but Sobel said the terms of the loan are not ideal.

"It's just a very fine line we're trying to walk here, as far as when to use the money. Do we treat it, as you know, go for maximum forgiveness? Or do we try and use it as more of a loan and extend it as far as we can?" Sobel said.

The loan offers forgiveness if you use it for payroll for your entire staff prior to furloughs. You can use 75 percent for payroll and 25 percent for rent and utilities.

The catch is the business owner has to use it within the first eight weeks from receiving the loan.

"If you're only able to operate at 25 percent capacity, how do you bring back all those people. And once the money runs out, you're going to have to let them go again," said Sobel.

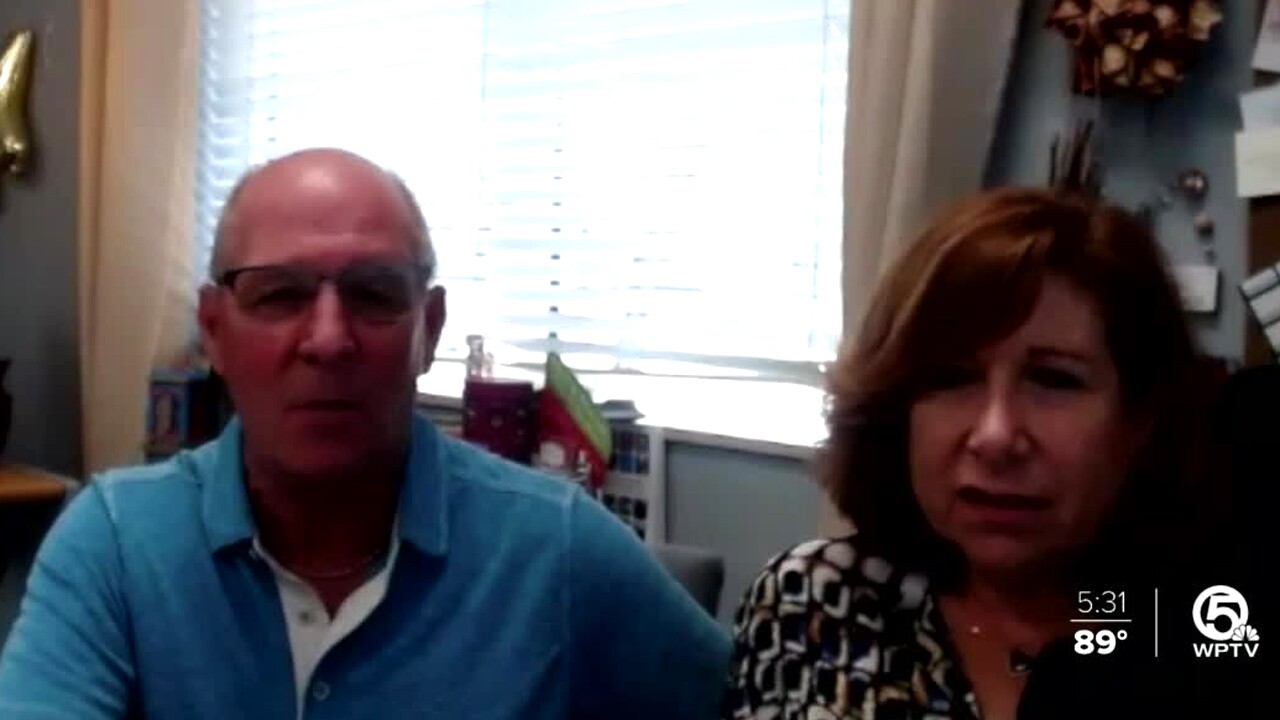

For Adrianne and Fred Weissman, the owners of 10 Evelyn & Arthur retail locations, getting approval for PPP was not as easy. They weren't even considered by their bank, so they had to go to a smaller bank.

They said the pandemic reminds them of the struggles brought on by the recession 10 years ago, only this time there is more help from the government.

"The hope is that in the eight weeks that you have to use this money that life is going to go back to normal, and you're going to be able to have the cash flow to pay your employees yourself, but that's a lot of hope," said Adrianne Weissman.

Some of their Evelyn & Arthur stores are located in counties that are able to open at 25 percent capacity.

"You have to throw out the plans you had and come up with a new norm a new reality," said Adrianne Weissman.

So, what's their advice to business owners who haven't been able to get the loans?

"It's really important to stick at it. It's worth the work," said Fred Weissman.