Older generations often stereotype younger Americans as lacking financial savvy, particularly when it comes to saving money. Yet some members of Generation Z are determined to dispel that notion.

However, for many in this group, saving for big-ticket items, such as retirement, remains a low priority.

Moving Forward with Intentions

Brook Kaplan, a 26-year-old nurse, exemplifies a proactive approach to her finances.

"Saving money is definitely important," she told Scripps News. "I want to feel prepared for my future — saving up for big purchases like buying a house so that I'm set in case of any emergency."

RELATED STORY | Changing jobs? Don't let hidden 401(k) fees derail your retirement savings

Kaplan's perspective is not widely shared among her peers. According to a survey from TIAA, only 20% of Generation Z members are setting aside money for retirement.

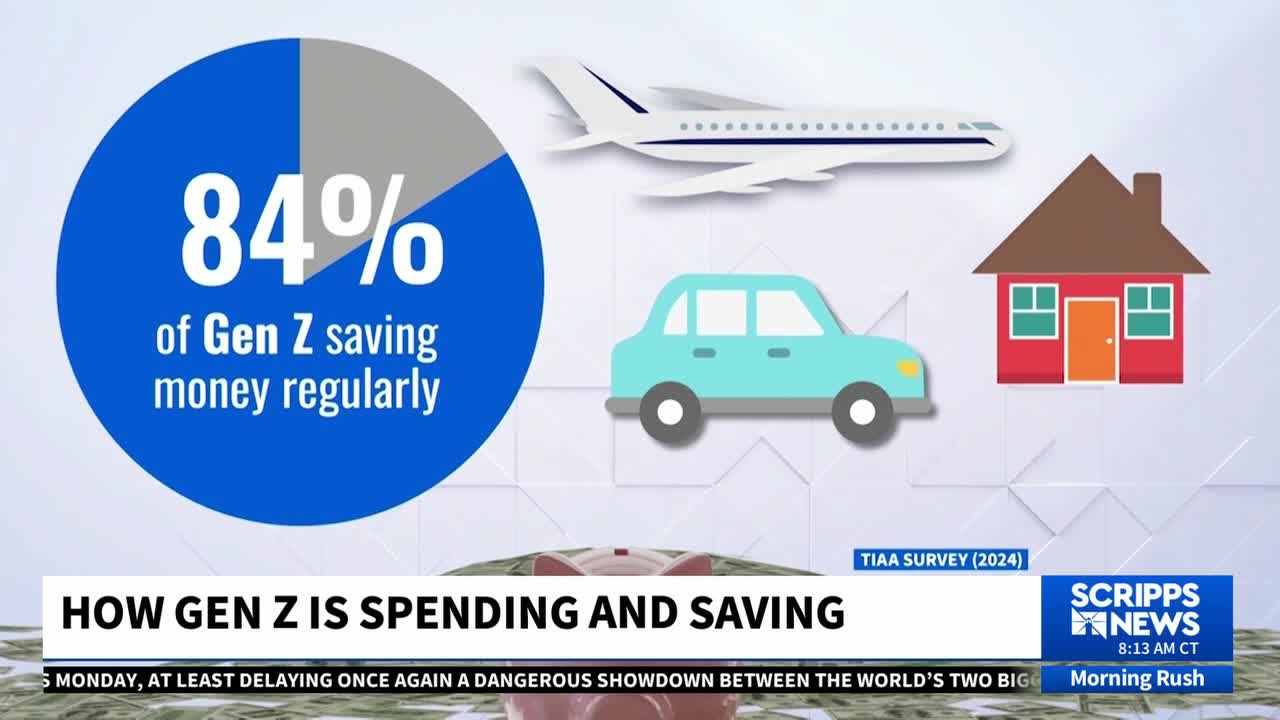

On a positive note, 84% of respondents are saving regularly, but they focus on immediate goals such as travel, transportation, and housing.

Flexible Savings Approaches

"They are not necessarily thinking of retirement in the sort of traditional sense of 'I'm gonna work in one career, retire at age 65, stop working entirely,'" explained Melody Evans, vice president wealth management advisor at TIAA. "They're really saving with the prioritization around flexibility."

Among Gen Z'ers not saving for retirement, 35% cite a lack of knowledge as a barrier. Meanwhile, 61% report that their first encounters with financial education began at home.

Navigating Information Overload

While many in Generation Z benefit from abundant financial information available online — through social media, podcasts, and other platforms — Evans highlights potential pitfalls.

IN CASE YOU MISSED IT | Is $1 million dollars enough for retirement? Experts weigh in

"If we have all sorts of financial influencers out there, people giving different information that's not necessarily vetted information," she said.

Leading the Way in Retirement Savings

Despite some hesitations, Generation Z shows promise in areas such as retirement savings. Research from Vanguard indicates that they are contributing to 401(k) plans at a rate more than double that of Millennials two decades ago.

Furthermore, over 25% of Gen Z'ers sought advice from financial professionals for the first time in the past year, outpacing their Millennial counterparts.

A Gendered Perspective on Saving

An interesting trend from the survey data reveals that more women in Generation Z are saving for retirement through 401(k) plans than their male peers. Evans notes that this shift could play a significant role in closing the gender wage gap, which has long been a concern in the financial landscape.

This story was initially reported by a journalist and has been converted to this platform with the assistance of AI. Our editorial team verifies all reporting on all platforms for fairness and accuracy.