WEST PALM BEACH, Fla. — With the recent collapse of Silicon Valley Bank and Signature Bank, many consumers who are customers of small banks are wondering if their bank will be next.

Less than an hour before the markets opened Monday, President Joe Biden responded to regulators seizing a pair of U.S. banks in recent days.

Regulators seized Silicon Valley Bank on Friday and New York-based Signature Bank on Sunday. The two seizures resulted in two of the three largest bank failures in U.S. history.

"Americans can have confidence the banking system is safe," Biden said.

He emphasized that taxpayers would not pay for the expenses to operate the banks and said bank fees would cover costs. The president added that bank management would be fired and investors would not be protected.

However, South Floridians who spoke with WPTV on Monday said they are worried.

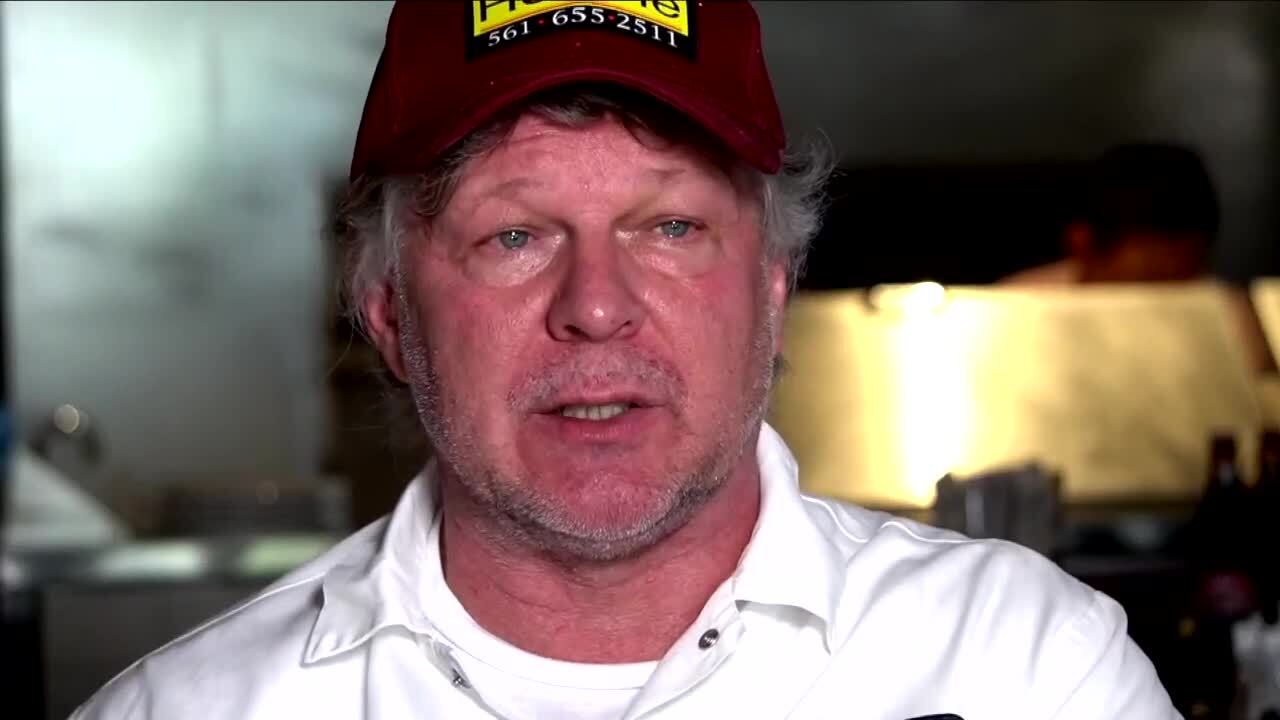

"A little bit fearful," John Ries, who owns Hot Pie Pizza in downtown West Palm Beach, said. "You know, the uncertainty is what makes me very, very nervous."

Ries said that's because he does business with a small, locally owned bank.

"I'm really at the winds and the ways of what the government's going to set up as their standards for protection," Ries said. "So, I do trust the government situation and their standards to help me."

WPTV spoke with Carl Gould, a business analyst who runs the firm 7 Stage Advisors, about the situation.

"There is a risk when you put your money in a bank, and that's why it's important to know that $250,000 of your deposits are insured by the FDIC," Gould said.

WPTV asked Gould if business owners who might have more money in their bank accounts should be worried.

"What we recommend to our clients is that you diversify your deposits in separate banks. So, for example, open up an account at another bank, put your payroll money in there. Open up a third account in a third bank, put your taxes — your tax funds — in there," Gould said. "Silicon Valley Bank, they were in a very specific niche and they were funding startups and tech companies, which are highly volatile. However, when interest rates go up, when inflation goes up, it does put some stress on banks. So, I do think we are going to see some other isolated bank failures."

It's a possibility that Ries said he's not spending too much time thinking about it, but he's aware of it.

"I have the faith and trust, but that doesn't mean I'm not scared," Ries said. "It does not mean I'm (not) a little bit fearful."