Corporate bankruptcies are at its highest levels since the great recession in part of a growing trend among billion-dollar businesses that experts believe isn't going away anytime soon.

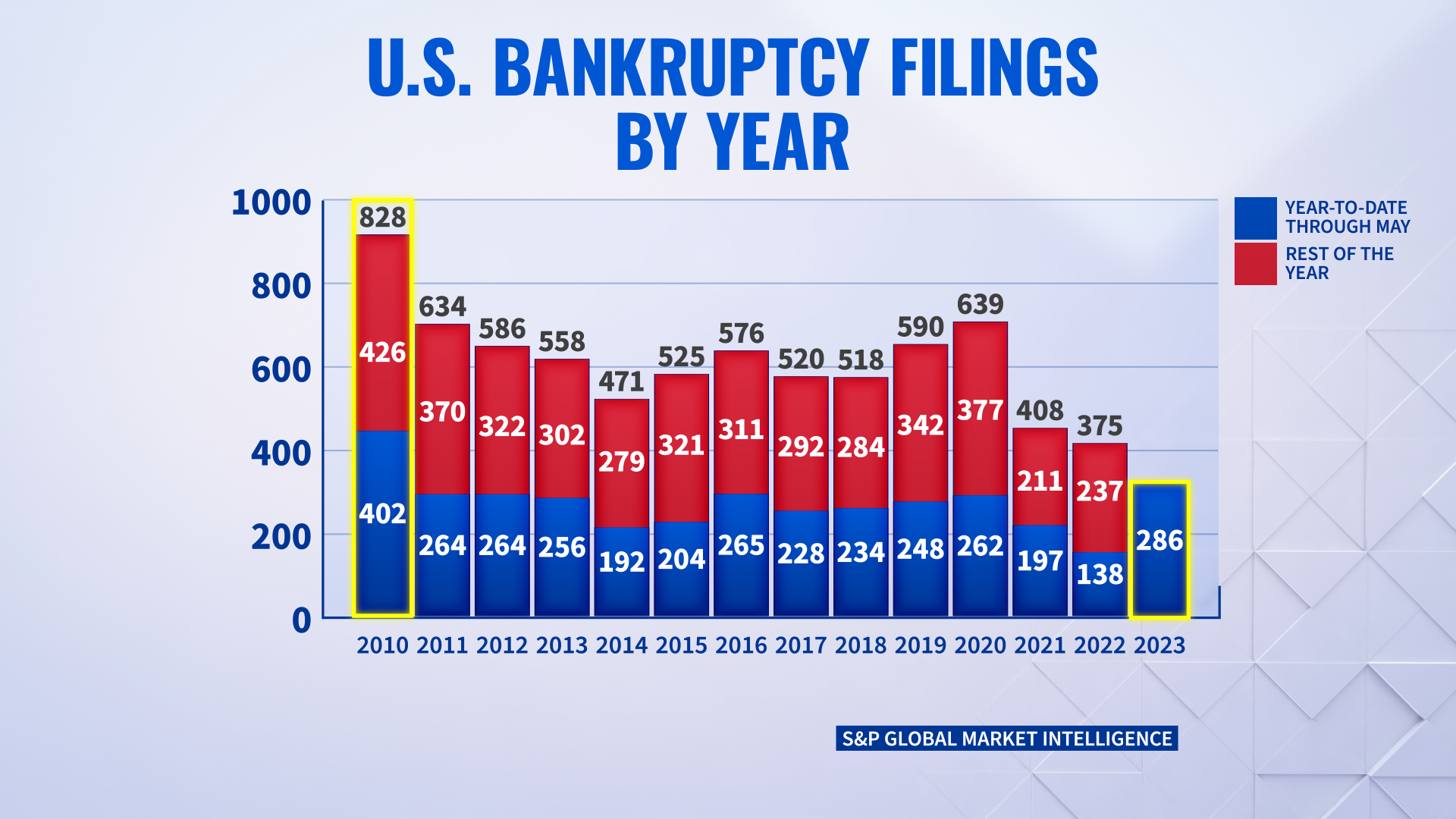

Party City, Bed Bath & Beyond, and mattress seller Serta Simmons are just some of the nearly 300 corporations that have filed for bankruptcy so far this year.

According to new data from S&P Global Market Intelligence, that's the highest year-to-date total since 2010, which saw over 400 bankruptcies in just five months.

Corporate bankruptcies also rose slightly from April with 54 companies filing in May.

Some of the most notable include Jenny Craig, Vice Media and Monitronics International Inc., the parent company of Brinks home security.

Monitronics was also among 11 companies this year that entered bankruptcy with more than one billion dollars in liabilities.

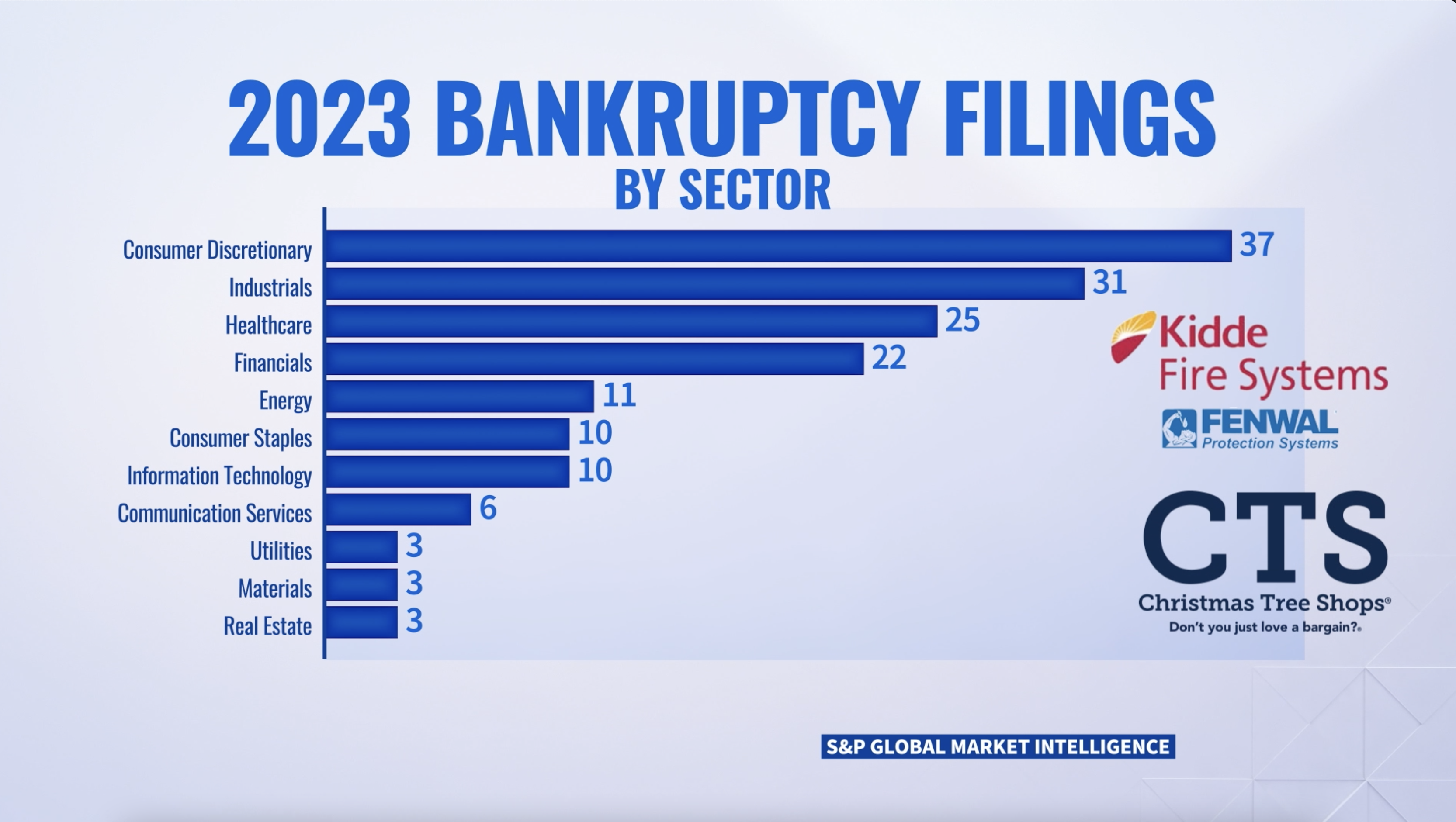

Most of the companies going bankrupt sell non-essential consumer products, including fire protection company Kidde-Fenwal or the specialty retail chain, Christmas Tree Shops.

Bankruptcies among large corporations are down from their peak in March, but are slowly creeping up again as the Federal Reserve continues to drive up interest rates amid a period of record inflation.

The filings also show how dependent companies were on borrowing easy money with low interest rates.

Like Vice Media, which said in its filing last month it took out big loans and complex investments as its cash flow depleted.

But as interest rates rose, the company couldn't keep up with paying its debt. Industry analysts believe the trend is sticking around for the time being.

According to the New York Times, the chief global economist at Vanguard warned investors to expect banks to cut back on lending.

That means more companies could cut costs, lay off workers, and eventually become more names on the list of bankrupted businesses.

Trending stories at Scrippsnews.com